End magical fiscal thinking

A new president’s first budget will and should reflect the vision on which he or she campaigned. It must also reflect the nation’s fiscal and economic needs, both cyclical and structural.

The nation’s needs will partially be a function of the near-term economic conditions and the state of the economic cycle. The first budgets of new presidents in 1993 (Clinton), 2001 (Bush), and 2009 (Obama) each faced different points in the economic cycle. Clinton was sworn in at the beginning of an economic expansion; Bush took the oath with a full employment economy and a budget surplus. Both economies were quite different from the one Obama inherited, in the depths of the Great Recession.

The next first budget must also confront four major structural challenges that will greet the new president at the White House door in January 2017:

- Slow growth, driven by both weak productivity and a decline in labor force participation

- High levels of economic inequality

- Our uniquely expensive health care system

- A shortfall in revenues needed to meet budgetary obligations and future challenges

Even while we live in extremely partisan times, both parties agree that the first three are, in fact, structural problems. Moreover, there is some good fiscal news here: While we have a long way to go to reliably control the growth of health care costs, measures introduced through health care reform to reduce cost growth appear to be having their intended effect.

On the fourth issue, our budget process is in shambles due to the gridlock and dysfunction that has characterized Washington in recent years. At worst, instead of dealing with our cyclical and structural challenges, fiscal policy has inflicted wounds on the economic recovery. At best, policy makers have deepened economic uncertainty by creating fiscal cliffs, sequestered spending caps, debt ceiling showdowns, short-term budget patches, and a government “shutdown.” Even when Democrats and Republicans have found compromise, as in the December 2015 budget/tax deal, it was done in such a way as to exacerbate the revenue problem on which I focus below.

Unless the parties internalize the following lessons and find a way to incorporate them in the budget process, the likelihood that the next president will be able to pass a first (or second or third) budget that effectively addresses either cyclical or structural challenges is low indeed.

The cyclical outlook

Along with incorporating the vision of the new administration, the president’s first budget must meet the economy where it is. Looking ahead one year, we are approaching—but have not yet reached—a fully employed economy. As the economy moves closer to full employment, so should our fiscal policy move towards stabilizing and then reducing the ratio of our debt to our GDP.

What the economy will look like a year from now is quite difficult to predict, so let’s start with where we are now. The ongoing economic expansion, which began in June 2009, is already long in the tooth at six and a half years. The average expansion since the mid-1940s lasted about five years, though more recent expansions were a bit more durable. However, it’s been a slow recovery and there are very few signs of over-utilization or financial (or housing) bubbles. To the contrary, by early 2016, GDP growth still hasn’t been fast enough to close the gap between actual and “potential” economic output. Slack still exists in the labor market, for while the unemployment rate is low the underemployment rate is still elevated. Inflation is extremely low, in part due to the historically low price of energy. So while economists are notoriously incapable of predicting recessions, there’s certainly no evidence of “overheating” and at least a decent chance that the economy will still be expanding by 2017.

If so, then the first budget should work off of the principle of “optimal fiscal policy.” When the economy is on a solid growth path and resources such as labor and capital are either fully utilized or reliably moving in that direction, the federal budget should be moving toward primary balance. That is, annual government revenue should cover all government spending other than interest payments. As long as the budget is in primary balance, the growth of the debt will match that of gross domestic product (GDP), i.e., the debt-to-GDP ratio will remain stable.

These days, primary balance is a budget deficit between 2 and 3 percent of GDP. And, in fact, according to the latest analysis by the Congressional Budget Office—Washington’s non-partisan scorekeeper—the deficit has been in that range (most recently, 2.5 percent). Our debt ratio has stabilized at around 73 percent of GDP.

As a recovery progresses toward full employment, optimal fiscal policy calls for budgets that do better than just holding the debt ratio steady. At full resource utilization, we need deficits that are smaller than primary balance so that the debt ratio falls. There are two reasons to pursue this goal. First, a smaller debt ratio reduces our interest burden, which is predicted to be the fastest growing part of the budget in coming years (though very low interest rates have helped mitigate these costs of late). Second, when we hit the next recession, we’ll want to be able to borrow again, and given the interest burden just noted, it would be better to do so from a lower perch than the current 73 percent of GDP (the average since 1965 has been about 40 percent).

This dynamic aspect of fiscal policy is very poorly understood. At least in their rhetoric (if not in their budget votes), some policy makers tout the value of balanced budgets without recognizing that the pursuit of a balanced budget in recessions would completely hamstring countercyclical policies and worsen the pain of recession. Sadly, this is the story of various European economies, where “austerity” measures—fiscal consolidation even in recession—has done lasting, long-term damage to their economies.

In fact, getting this part of the policy right is more important than ever. Our central bank, the Federal Reserve, just raised the target rate to 0.25-.50 percent after targeting zero for an unprecedented seven years (this refers to the federal funds rate, the benchmark interest rate set by the Federal Reserve). While the future path of rates is of course unknown, markets believe they will be low for years to come. Stimulative monetary policy may be of limited help in the next recession, as the interest rate the Fed controls will be too close to zero to make much of difference when they lower it. Thus, if the economy hits full employment, it would be smart fiscal policy to reduce the debt ratio so as to create the borrowing space necessary to respond to any future recession.

Operationalizing the above in the new president’s first budget will thus be a function of the economy he or she inherits. If the recovery is ongoing, we should be at or close to full employment. In that case, the first budget should at least achieve primary balance and strive to do better than that, i.e., to balance spending and revenues such that the near term deficit is below 2.5 percent, leading to a decline in the debt-to-GDP ratio.

This goal will be made more difficult by the budget bill signed in December 2015, as it passed a number of tax cuts—unpaid for—that added to the deficit over the 10-year budget window. This implies the need for significant changes in the fiscal thinking that’s predominated in recent years.

The structural outlook

Various structural challenges will greet the next president: slowing GDP growth, growing inequality, pressures from health care costs, and the need for more revenues. Interestingly, there is bipartisan consensus on the first three, though strong disagreement on the last.

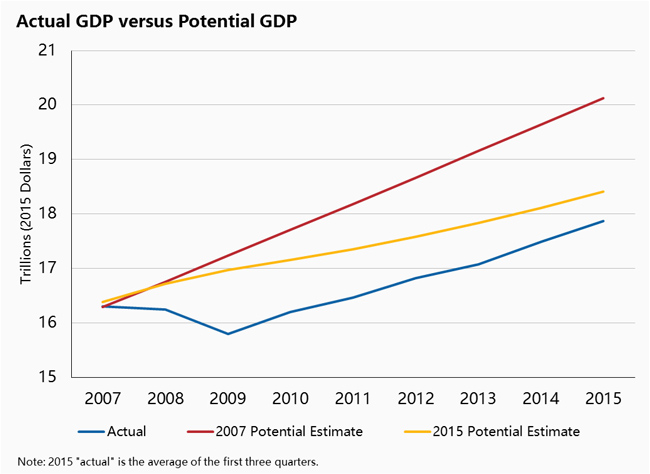

Democrats and Republicans tend to agree that the economy is growing slower than expected. The figure below plots three versions of real GDP. The top line shows what the CBO considered to be potential GDP back in 2007. The next line shows their 2015 re-estimate of that concept, and the bottom line shows actual GDP.

We still haven’t closed the output gap that developed in the Great Recession. The second thing to note is how potential GDP is lower in both level and growth rate (or slope). If actual GDP were a runner, she’d be running too slowly to cross a goal line that’s moving towards her!

The factors that explain the downgrade include the sluggish recovery, diminished labor supply, less investment, and slower productivity growth. What, if anything, can the next president do about this unsettling structural trend? How can the next president’s first budget make a difference in the trajectory of those lines in the figure?

Members of both parties agree on two steps to improve the economy: stepping up investment in public infrastructure and reducing economic inequality.

Members of both parties agree on at least two steps—which could be passed in a bipartisan way in the president’s first year.

The first is stepping up our investment is public infrastructure. As economist Larry Summers recently pointed out, “the United States is currently investing the lowest percentage of its output since World War II on roads, ports, airports, bridges, air traffic control towers, and schools.” Summers asks, “How can we convince children that education is a high priority when paint is chipping off their classroom walls? Why are we waiting for bridges to collapse before we address their structural weaknesses? Why are we allowing ourselves to fall behind the rest of the world by not investing in modern wireless and broadband technologies?”

Compelling questions indeed, especially given the well-documented infrastructure deficits in our stock of public goods and the realization that, historically, such investment has been a solidly bipartisan cause. Businesses depend on such infrastructure to build their supply chains and adequately educate the future workforce. Moreover, such investments have the potential to both increase productivity growth and reduce slack in the job market. It is thus not surprising that the conservative Chamber of Commerce argues on their website that infrastructure investment should not be viewed as a political problem but an “opportunity for bipartisan agreement to invest wisely…”

The second structural challenge is reducing economic inequality. The fact that partisans at least now agree on the problem is a positive step, but there is little agreement on what to do about it. From the perspective of the budget, however, there is one area that may cross even today’s entrenched party lines.

The most important aspect of the next president’s budget is the need for more revenue.

Human capital is a public good that is of equal, if not greater, importance than physical capital, a view shared by many in both parties. Helping to offset college costs is also a policy on which partisans agree. Many conservatives have supported the expansion of refundable tax credits tied to work. Congress just supported a permanent expansion of both the earned income and child tax credits, and both liberal and conservative policy makers have agreed that the too-small EITC for childless, adult workers should be expanded. In fact, it would not be surprising to see that much-warranted expansion in the next president’s budget.

The deeper structural divide

All of which brings us to the most important aspect of the next president’s budget: the need for more revenues.

Objective readers may balk at this notion. Surely, there are at least two options: Cut spending or raise more revenues. That’s true, though it may be politically unrealistic to believe we can cut our way out of the fiscal corner we’re in.

First, even with no policy changes at all, there are mechanical reasons why our revenues must increase. If we hold real spending per capita constant, simple population growth and inflation together will require a 40 percent increase in revenues over the next decade. Second, there are the aging boomers: Those 65 and older will increase from 15 percent of our population currently to 20 percent by around 2040. The fact that a larger share of the population will be in the age ranges supported by Medicare and Social Security implies more spending. The CBO estimates that by 2025, spending on Social Security and Medicare will need to go up by just under 2 percent of GDP (over $500 billion of projected 2025 GDP).

That’s holding policy constant, but what about cutting the benefits in these large, social insurance programs, often discussed under the rubric of “entitlement reform?” Don’t count on it in the next president’s first budget. The Democratic candidates have proposed expanding Social Security and Medicare, while those Republicans who have proposed cuts in social insurance typically delay them for 10 years, presumably for political reasons.

Moreover, if the next president does not want changes to these programs to increase poverty or inequality, there are not enough savings in entitlement reform to meet our budgetary needs. The typical income of a Social Security or Medicare beneficiary is under $30,000. For about two-thirds of the elderly, Social Security is their major income source; for 36 percent, old-age benefits account for at least 90 percent of their income, and these shares are even larger for minorities and for women. Without Social Security income, 42 percent of the elderly would be poor, as opposed to 10 percent with the benefits.

But what about the wealthy? Surely, we could cut their benefits without hurting their well-being. That’s true, but not enough of Social Security’s benefits flow to the rich to offset our revenue needs. In fact, ideas that reduce benefits to the wealthy, like changing the formula that calculates their benefits, typically close less than 10 percent of Social Security’s 75-year fiscal gap.

In other words, the only way to get real money out of “entitlement reform” by reducing benefits is to cut too deeply into the well-being of seniors who depend on it. You’d have to break social insurance to fix social insurance, and that is both bad policy and bad politics.

Any real savings will come from reducing the cost growth of health care, where large inefficiencies persist. This is why other advanced economies spend far less than we do on health care with comparable outcomes. Clearly, attacking these inefficiencies was a goal of the Affordable Care Act (ACA), and it has had some success in doing so: Today’s budget projections of health care costs are down 30 percent from those made prior to the ACA, and that improvement includes the costs of the health care reform itself.

We face a structural problem of insufficient revenues that we can’t cut our way out of.

If the next president is a Republican, he or she may have run on a platform that included the repeal of “Obamacare.” Whether he or she is able to do so, it is a fair assumption that the electorate would not tolerate a return to the pre-ACA status quo. Thus, whatever replacement shows up in a Republican president’s first budget would likely have many of the characteristics of the ACA, with certain aspects “dialed back,” such as employer mandates and coverage standards.

So to find needed revenues, what matters most are more efficient delivery system changes that emphasize the quality of health care services over the quantity. Under the ACA, that has led to interventions such as “bundled payments” (an overall fee covering all the care related to a procedure), “accountable care” models (providers have monetary incentives to reduce spending below a set level while maintaining quality), and bonuses to reducing re-hospitalizations. If the next president’s first budget repeals the ACA, it is critical that these sorts of measures are introduced as part of its replacement.

Thus, if we accept that entitlement reform cannot worsen inequality or poverty, simply based on the realities of population growth, inflation, servicing existing debt, and aging baby-boomers, we face a structural problem of insufficient revenue that we can’t cut our way out of. Health savings from efficiencies in service delivery can help, but the fact that the current Congress is already chafing at the bit under spending caps they imposed on themselves—caps they’ve consistently jettisoned through a series of budget patches—suggests the depth of the problem.

An end to magical fiscal thinking

The next president’s first budget should incorporate two assumptions:

- There’s nothing wrong with even large budget deficits to temporarily offset a recession. The key is for those deficits to come down in strong economies. When it comes to the budget, we should be cyclical doves and structural hawks.

- To meet the structural shortfall in tax revenues, the next president cannot continue to work from a fiscal model that tells the electorate they can have what they want without paying for it. That doesn’t have to imply a greater tax burden; it could involve significant spending cuts. But we cannot maintain our current system of social insurance as it expands to meet demographic realities, support an adequate defense against adversaries, and fund robust educational opportunities and a productive infrastructure while pledging to never raise taxes.

Under no realistic scenario can we absorb tax cuts of the magnitude proposed by many of those currently running for president and maintain the public goods listed above. Nor, on the other side of the aisle, can we raise the needed revenues solely on the top few percent of the wealthiest households.

In other words, there needs to be an end to “magical fiscal thinking.”

The private market, as uniquely flexible and resilient as it is, cannot and will not provide these public goods. It may be that the politics invoked by this reality are too demanding and that few of today’s policy makers are willing to tell it like it is. If so, that’s unfortunate, because at the end of the day, we’re in this together, and we can either decide to pay for—in a progressive manner—the menu of public goods we want or we can decide we don’t want to. Were we, as a nation, to make the latter choice, I would worry about our future. But at least it would be a realistic choice.

What we can’t continue to do is what we have been doing: Pretend we can meet the challenges we face without paying for them. Given political realities, the next president’s first budget is unlikely to completely pull back that curtain, but perhaps he or she could start the honest conversation.