Ten Years Later: Reflections on the 2008–09 Financial Crisis

We avoided disaster, but there are still lessons we need to learn

Lawrence H. Summers is the Charles W. Eliot University Professor and president emeritus of Harvard University. During the past two decades, he has served in a series of senior policy positions in Washington, DC, including the 71st secretary of the treasury for President Clinton, director of the National Economic Council for President Obama, and vice president of development economics and chief economist of the World Bank.

In January 2019, Summers was a key participant as the Miller Center convened a look back at the financial crisis and Great Recession of 2008–09. The sessions were held at the Brookings Institution in Washington, DC, which co-hosted the event along with UVA's School of Law and Darden School of Business. The following is adapted from his remarks.

Did we do right thing?

No. Then yes. Then no.

If you looked at what was happening to the economy in 2007, at the runup to Bear Stearns failing and what happened to after Bear Stearns failed, there was obviously a gathering storm. Nobody did much except react. Banks were allowed to continue paying dividends. Nobody was forced to recapitalize. The situation drifted along. There should have been shock and awe of capital, a recognition that maintaining demand was the most important objective of macro-economic policy. Yet nobody did much. It was an obvious mistake, even at the time.

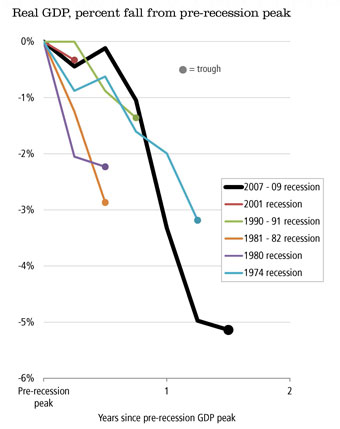

But in the crucial period of six months between the time Lehman Brothers fell and the period after the stress test, America rose to the occasion. The banks were substantially recapitalized; significant fiscal stimulus was delivered; substantial interventions to provide liquidity to the financial markets were engineered; and the sharpest “V” in the history of the major economies was recorded between the first and second quarters of 2009. On the precipice of a truly historic economic calamity, we acted decisively, appropriately, and effectively. And this was by far the most important period to get it right.

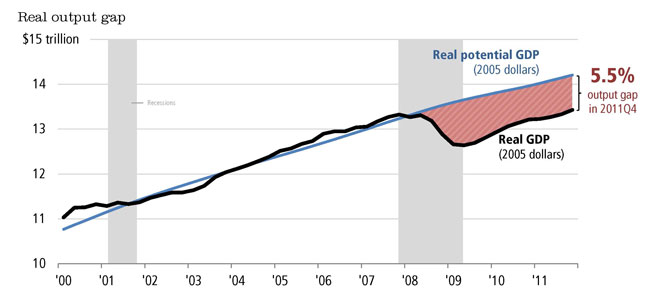

By the end of 2009, however, driven by misguided concern about budget deficits and a desire to get to long-run agendas, we declared that the green shoots of recovery were at hand and left the battlefield. Demand was still too weak to drive a robust recovery, and as a consequence, the expansion was substantially slower than it could have been, with less capital investment and more people unemployed for a longer period of time. The lost output certainly cast a shadow forward.

So at the most important moment, we acted. But we waited too long and declared victory prematurely.

Could we have avoided a populist backlash?

There are reasons rooted financial crises in general that serve as catalysts for populist uprisings: in particular the need to provide support to existing financial institutions, especially powerful ones, at the same time that masses of people suffer dislocation. But had we adopted more draconian policies towards the financial institutions, would it have somehow curbed the populist pressure?

The best natural experiment says no. Britain nationalized two of their four major banks, yet they got “Brexited” at about the time that we got Trump.

Then there’s the more extreme anti-establishment solution: the government simply stands back and lets businesses fail. The economic fires burn themselves out, the theory goes, without taxpayers putting any money in. We have a natural experiment for that, too, and it was what made the Great Depression great.

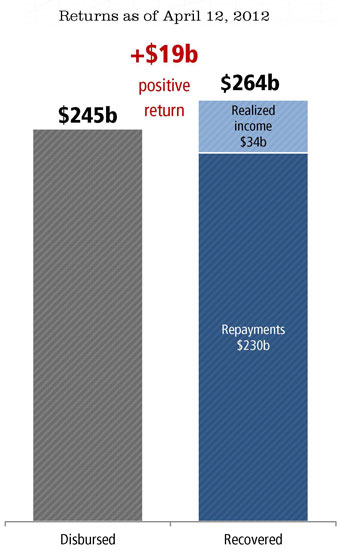

In fact, if you look at a graph of any interesting economic statistic from the beginning of the fall of 2008 to the beginning of 2009, it looks kind of just like the Great Depression did after 1929. And if you look at the subsequent five years, although our economy could've been better, it doesn't look anything like the Depression. Unemployment peaked at 10 percent, not 25. Had we decided against government action, we would have had something like the Great Depression. And even in terms of the federal budget alone, the government would lost 10 times as much revenue from the destruction of our economy as it would have gained from not having to spend money on bail outs—the vast majority of which came back to the government anyway.

Should we have nationalized banks?

When you nationalize an institution, the first question everyone asks is, “What happens next?” The situation is temporary, so how does it end?

Inside the bank, employees will generally make a fairly obvious calculation: If the government’s going own and liquidate it, people who can get other jobs usually do. Talent leaves.

On the consumer side, debtors owing money to a bank that will never give them a new loan feel less pressure to pay back the old one. New customers give their business to banks that aren’t in liquidation and run by the government. For all these reasons our experience is that government intervention in banks is invariably a major destroyer of asset value. It would have been far more expensive for taxpayers had the government intervened in the banks. And those weaker banks would have been far less helpful in contributing to the recovery.

There were those who said at the time, “Well, what about the Swedish model?” But the Swedish government already owned 80 percent of the banks before the crisis started: The government putting additional capital into a bank that it already 80 percent owns really isn’t analogous to the situation we were facing. As for comparing this crisis to a standard intervention by the FTC, there certainly wasn’t anybody sitting around in the middle of the biggest financial crisis in 60 years ready to absorb a big bank as if it were a community bank.

Others simply say that banks didn’t suffer enough compared to everybody else. But if you were a shareholder in the banks that people talked about nationalizing, after we've had a 10-year recovery your investment is worth about 10 percent of what it was before the crisis started. To enact a harsher penalty, you would have had to destroy an enormous amount of value.

Is capitalism itself in crisis?

Many of the problems of capitalism are actually a feature of its success. It is a truism that middle-class wages have been stagnating. But we should remember how dramatically more efficient our economy has become. It takes takes about a third as many working hours to purchase a refrigerator as it did in 1973. It takes half as many hours to buy a shirt; one-sixth to buy a television. If you take the goods produced by what we think of as capitalism, there has been a massive increase in purchasing power over the last 45 years.

The challenge is how do we adapt to that increased efficiency, which is very much like what happened to agriculture. Agriculture has become so efficient that now it's kind of irrelevant to the economy, less than two percent of our working population. And that what's happening to traditional capitalist—particularly manufacturing—activity. Today in America only a four-and-a-half percent of workers are doing production work in manufacturing. There are more 50-year-old men on disability than doing production work in manufacturing—precisely because it's become so productive. Fewer people are producing goods. More people are producing services.

What do we do in healthcare? What do we do in education? What do we do in housing? How do we handle social media? The difficulties and challenges come not from not the workings of capitalism but from the particular activities our workers move to as traditional capitalism succeeds. These are the ch economic policy challenges for the next generation. You can't think about healthcare the way you think about the market for shirts. You can't think about taking care of the aged the way you think about selling automobiles.

So is traditional capitalism enough? No. But rejecting traditional capitalism would not—if you look at places such as Venezuela, Cuba, and North Korea—seem to be the answer either. As for China, anyone who looks at it thoughtfully has to say that, for the most part, the reason China has done phenomenally well over the last 40 years is that there are a lot more markets, a lot more property, and a lot more openness to the rest of the world than there used to be. A broad rejection of capitalism is a poor substitute for taking on the real economic challenges that face the United States today.