Ways to give to the Center

There are many ways to make a gift to the Miller Center Foundation. Some may have added benefits depending on the donor’s age, type of asset contributed and the form of gift selected. The Foundation will work with you to craft the most beneficial gift for all concerned.

A gift of cash

By far, the easiest and most common way to support the Miller Center is to make an outright gift of cash. Checks should be made payable to the Miller Center Foundation, and mailed to:

Miller Center Foundation

PO Box 37963

Boone, Iowa 50037-0963

The Foundation's tax ID number is 54-1420895

Giving online with a credit card

One of the easiest ways to give is by using your credit card online. Simply follow this link to make a secure online gift. Or if you prefer, call University of Virginia Gift Processing Services at 434-924-7018

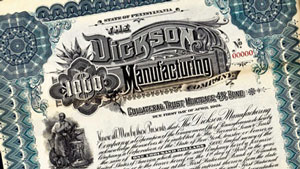

Gifts of appreciated securities

Making your gift with long term appreciated securities is a tax wise method of supporting the Miller Center. When making a gift of appreciated stock, bonds, or stock options with long term gains, the donor pays no tax on the capital gains and can take a charitable tax deduction for the fair market value of the security (up to a 30% limit of adjusted gross income.)

Corporate and foundation support

The Miller Center has a long history of developing productive relationships with corporations and foundations. During the course of the last 40 years, the Miller Center and its philanthropic partners have worked together to fund important programs of national significance:

- Issue-specific National Commissions such as the "Commission on Federal Election Reform" co-chaired by former Presidents Ford and Carter in 2001. The commission was generously funded by the William and Flora Hewlett Foundation, the David and Lucille Packard Foundation, and the John S. and James L. Knight Foundation.

- The Miller Center's web site is one of our country's most comprehensive and informative resources on the presidency. Over 5 million unique students, teachers, and citizens learn about the presidency each year, delivering 30 million page views.

- History is talking. Are you listening? Corporate and foundation events can be immeasurably enriched by adding an historical perspective to current events. Today, more than ever, our expert understanding of the presidency and our democratic system can help Americans to understand what came before, so they can see what's coming next.

A partnership with the Miller Center offers a philanthropic opportunity for corporations and foundations to positively effect national public policy by facilitating and promoting non-partisan research, reflection and reporting on the critical issues of our time.

Planned giving

Gifts such as bequests, real property, life insurance and retirement plan assets can have significant tax advantages. Consider establishing a charitable gift annuity or trust that will provide you with income for life while supporting the Miller Center.